For auto service financing we provide a 3 and 6 times monthly instalment for up to RM5000. If you take up 70 depending on the Open Market Value of the car financing you will not have to find as much cash in the short term.

Mortgage Terminology 6 Things To Know Before Taking Home Loan

About home loan specialists.

. The interest rate in an ARHL is linked to HDFCs benchmark rate ie. This calculator helps you estimate your home loan eligibility and what is the maximum amount you can borrow. For this loan you will be able to withdraw in excess of your current account balance to an approved limit.

These are as follows. If you have a 5000 loan balance your first month of interest would be 25. Car buyers with extra disposable income may wish to consider a flexible type of variable rate car loan that allows them to reduce the interest by depositing extra money into a linked account much like how a flexi home loan works.

Interest Rate pa 0 15. Monthly net income after income tax EPF and SOCSO Existing Monthly Debt Repayment other mortgages personal loans and hire purchases. However in the long run you will pay more money for your vehicle than if you had taken a smaller Amount Financed.

Find out the savings in EMI. Login to online banking. How much time will it take for my loan to be approved.

An Adjustable Rate Home Loan is also known as a floating or a variable rate loan. Borrow up to 75 of the cost to build or enhance your dream home. Tenure Years 1 30.

There are a few factors that determine your eligibility and may differ from bank to bank. For example someone with 100000 cash can make a 20 down payment on a 500000 home but will need to borrow 400000 from the bank to complete the purchase. For private sector personal loan you can borrow up to RM20000 with loan terms between 1 and 4 years.

Several years down the road an unfortunate fire has gutted most of the building and its content leaving you and your family in distraught. If you wish to take up asset acquisition then you can consider applying for a term loan. Interest rates for housing loans in Malaysia are usually quoted as a percentage below the Base Rate BR.

You can repay your loan on a monthly basis via Interbank GIRO IBG cash deposit cheque deposit or MEPS ATM fund transfer. As of 2nd January 2015 Base Lending Rate BLR has been updated to Base Rate BR to reflect the recent changes made by Bank Negara Malaysia and subsequently by major local banks the interest rate on a BR. The mortgage principal is 400000.

An HDFC home loan customer can choose between two types of interest rate options while availing a home loan. In Malaysia most car loans are the fixed rate variant. Hypothetically speaking you are committing hundreds of thousands-worth of a bank loan for as long as 35 years to purchase your dream house so that you can settle down with your loved ones.

You can apply for a Home Loan at any time once you have decided to purchase or construct a property even if you have not selected the property or the construction has not. Borrow up to 7 years and 70 of the purchase price or our valuation of the car whichever is lower. The amount of financing you need or should apply for depends on your personal circumstances.

Multiply that number by your remaining loan balance to find out how much youll pay in interest that month. Find out how much you can borrow with our home loan calculator more. A car loan in Malaysia is a type of loan that is taken by an individual for the sole reason of buying a car.

For instance you may use a personal loan to consolidate debt pay for home renovations or plan a dream wedding. The loan will be granted for a period of time and shall be repaid in monthly instalments. Borrow up to 75.

For example if the current BR rate is 400 Update. Get your loan approved in 60 seconds before visiting the showroom. How much loan could I borrow.

By taking up this loan this individual is tied down to a formal written agreement where the borrower car buyer is indebted to pay the loan amount plus interest to the lender banks financial agents etc over a specified period of time. The information provided on this website is for general education. Enjoy significant savings with Eco-Care Car Loan.

Your loan will be disbursed within 10 working days post receipt of the all required documents. A personal loan is an amount of money you can borrow to use for a variety of purposes. The loan can be repaid over a period of 12 to 60 months.

Adjustable Rate Home Loan ARHL. Retail Prime Lending Rate.

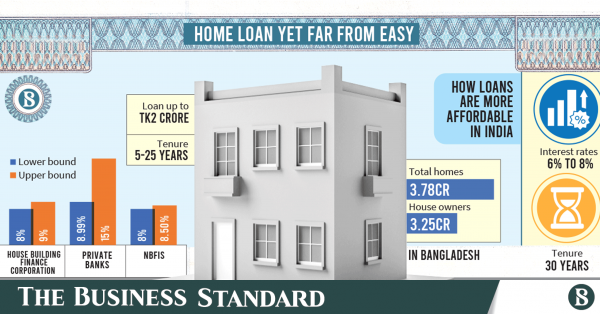

High Interests Difficult Terms Make Home Loan Unaffordable

How To Use A House Loan Calculator In Malaysia

Nri Home Loan Federal Housing Loan Plot Loan Federal Bank

4 Main Types Of Home Loans Find The Best Mortgage Option For You

How To Use A House Loan Calculator In Malaysia

The Complete Guide To Housing Loan In The Philippines Blog Citiglobal

Advantages And Disadvantages Of A House Loan Complete Controller

Home Loans For Nris In Other Location Nri Home Loans In Other Location Hdfc Ltd

How To Reduce Home Loan Interest Rate 2022

Opting For A Home Loan From A Bank A Step Wise Guide By Nvt Quality Lifestyle Home Loans Loan Helpful

Home Loan Eligibility Affordability Calculator

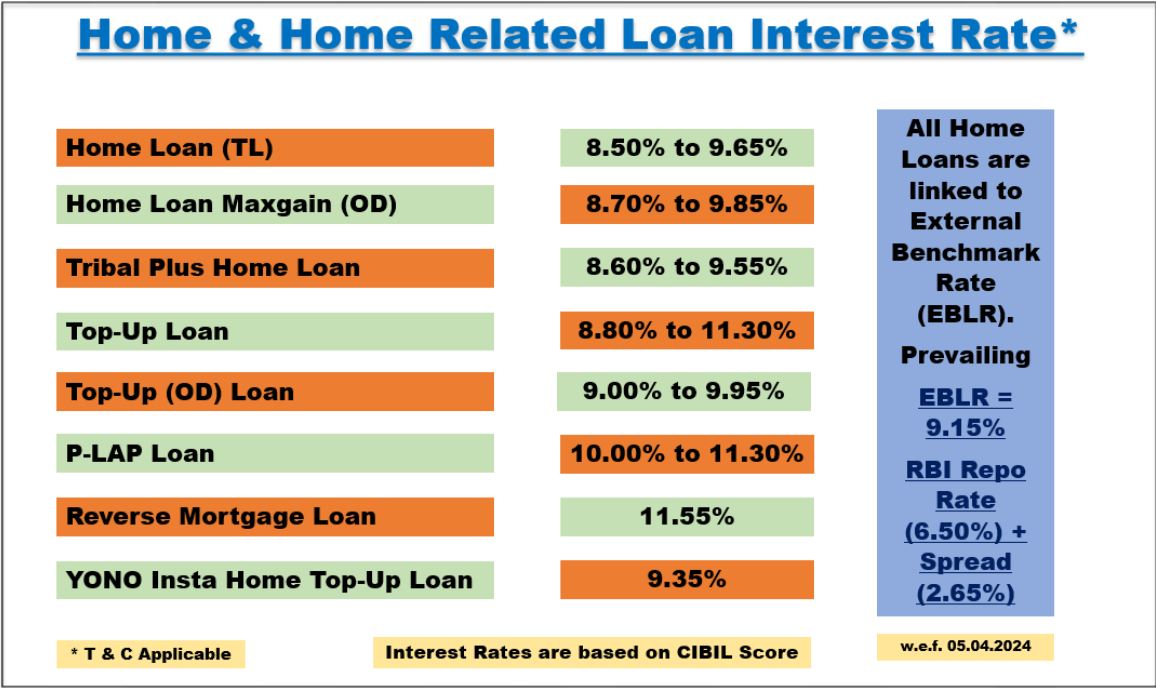

Sbi Home Loans Reverse Mortgage Loan

Home Loan Vs Mortgage Loan Know The Difference

What Is The Difference Between A Home Loan Mortgage Loan And A Loan Against Property Quora

I Have A Home Loan On My House Which I Want To Sell What Is The Process Mint

Refinancing Vs Repricing Your Home Loan What Are The Differences

Applying For A Housing Loan In Malaysia 6 Important Things To Know

High Interests Difficult Terms Make Home Loan Unaffordable